Written by Holly from Accounting SPOT

I have posted time after time about my love for QuickBooks. I am now offering my Tutorial on how to make QuickBooks Simple Start Online (the free version) work for your Etsy shop, for you to download for FREE! See below for details, Enjoy! :)

I have posted time after time about my love for QuickBooks. I am now offering my Tutorial on how to make QuickBooks Simple Start Online (the free version) work for your Etsy shop, for you to download for FREE! See below for details, Enjoy! :){Download tutorial HERE. Sign up for QB Online HERE}

-Due to many pictures and links, the download takes a couple of minutes.

*Are you looking for a free accounting solution?

*Do you have a modest amount of transactions?

*Do you want to use a tried-and-true accounting program?

*Are you unsure of how to make the free QuickBooks® Simple Start Online work for your Etsy shop?

If you are answering YES to these questions, THIS is the solution for you!

Included:

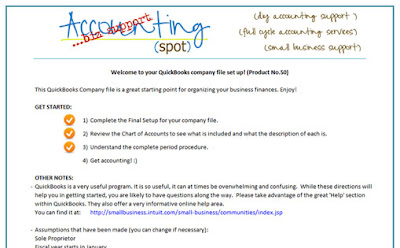

Simple to read, step-by-step tutorial on how to make the free QuickBooks® Simple Start Online work for your Etsy shop (product created in excel).

Compatible:

QuickBooks® Simple Start Online (free from Intuit), click HERE to view.

Details:

The QuickBooks® Simple Start Online tutorial provides directions on how to make the program work best with your Etsy shop. Using the QuickBooks® Simple Start is an easy way to track sales and expenses. All your finance information is organized in one place, so you can easily stay on top of your business and be ready for tax time.

What isn't always easy, is knowing how to set it up and make it work for you.

This tutorial gives you easy to understand, step-by-step directions (with pictures!) from setting up your company to posting transactions to reconciling to reporting. Start-to-finish!

If you've found this tutorial helpful, I'd love to hear your comments! Also, if you have a business blog, feel free to post a link so your readers can enjoy this tutorial as well. Thanks!

Holly Neitzel

MBA, Certified QuickBooks ProAdvisor

Accounting SPOT

P.S. (For the sake of full disclosure: I am a Certified QuickBooks ProAdvisor and Affiliate. I receive a small reimbursement if you sign up for QuickBooks® Simple Start Online using my link. This is not WHY I am offering this tutorial, but it is why I am able to offer it for free. Yay!)